So, it’s that time of year again. Gartner has released its Magic Quadrant for Enterprise Conversational AI Platforms 2023, and it makes for interesting reading.

I’ll be doing some deeper analysis on this over the coming weeks, but wanted to give you a quick synopsis of what’s changed since last year.

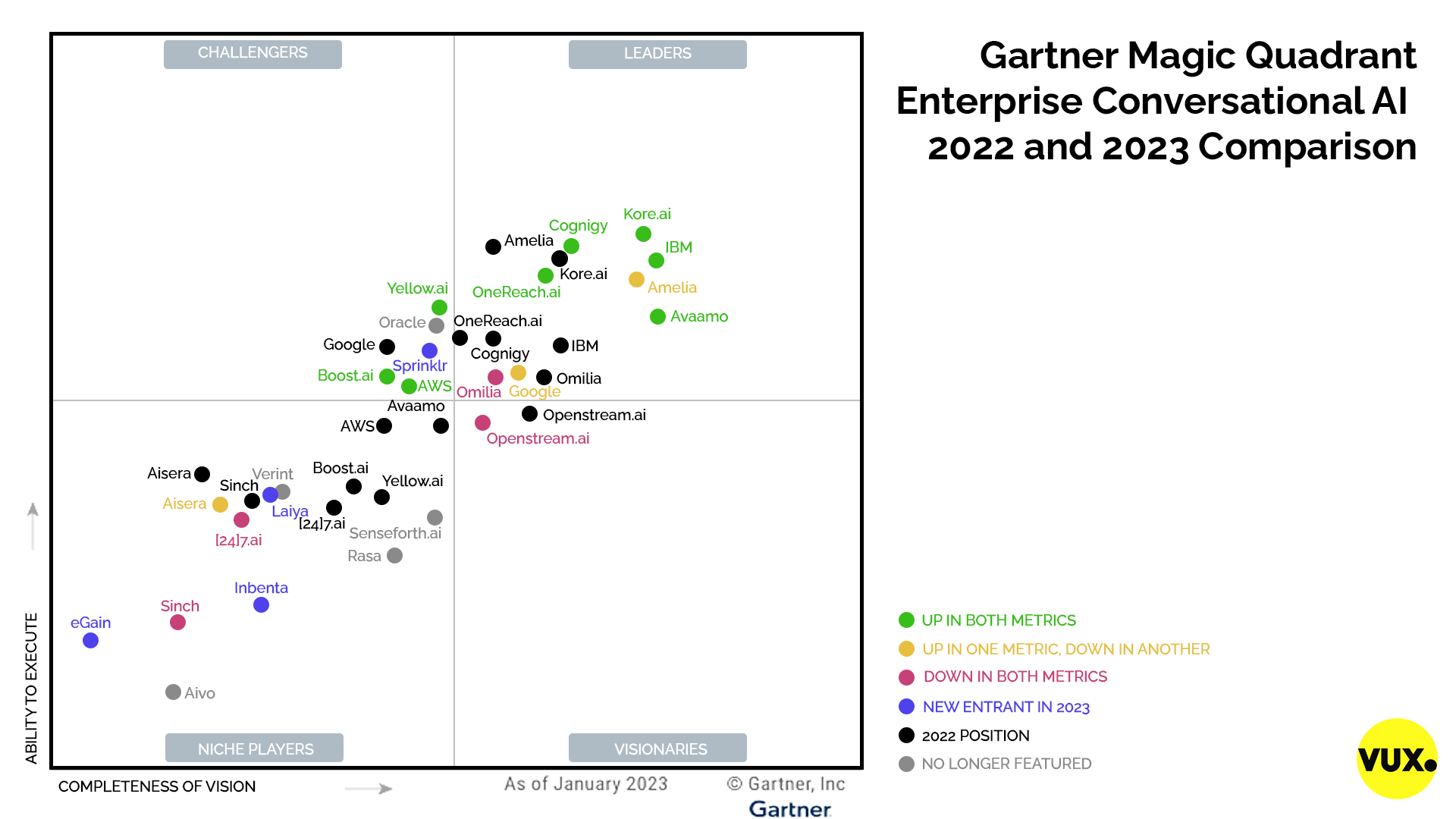

Showing 2022 MQ (black dots) compared to the 2023 MQ (coloured dots)

In a nutshell

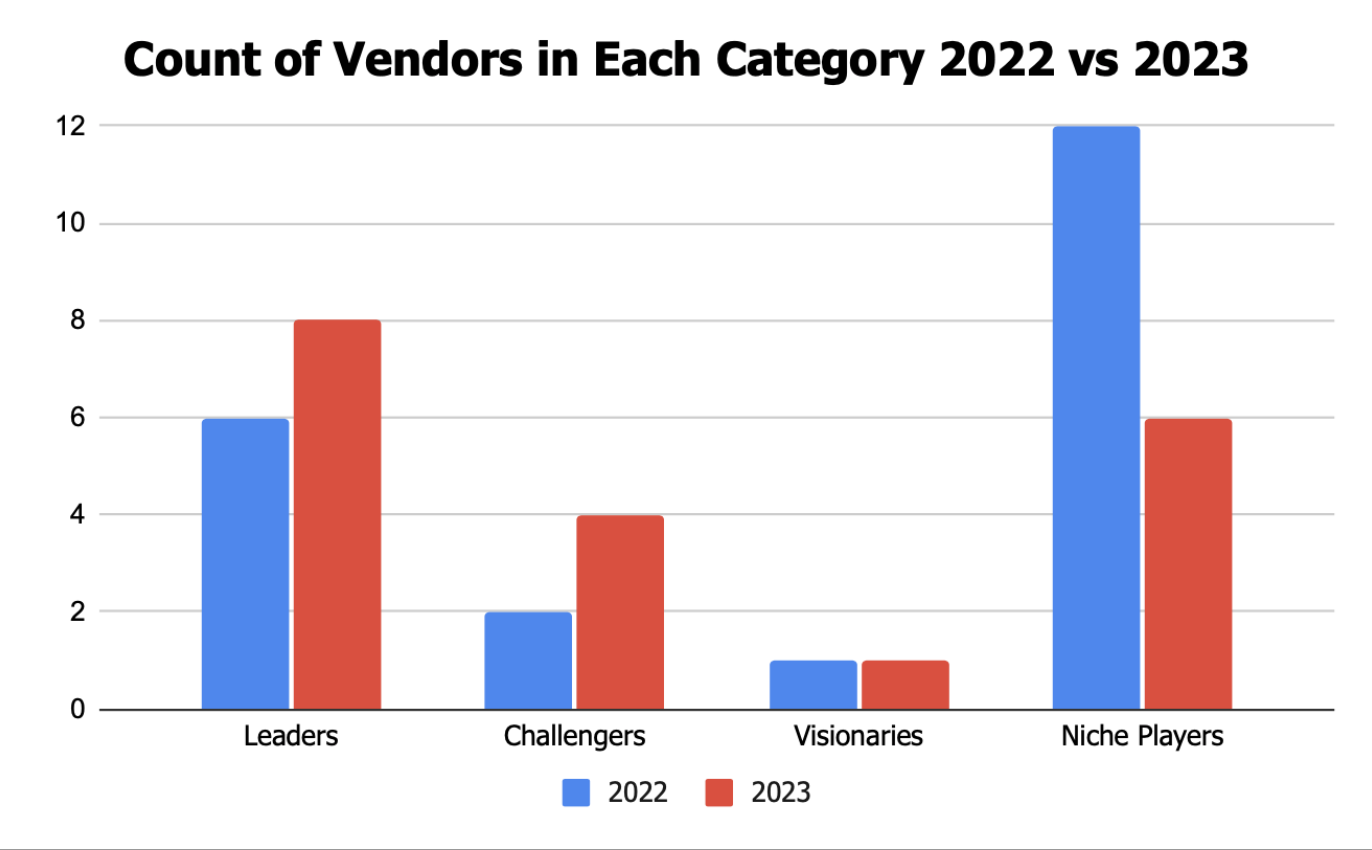

- There are 2 less companies in this year’s analysis. 21 companies featured in the 2022 report. This year, it’s 19.

- There are 2 more Leaders in this year’s MQ: Avaamo and Google join the Leaders of last year, who all remain Leaders this year.

- 6 vendors disappeared from the quadrant entirely: Oracle, Verint, Senseforth, Rasa, Aivo. This surprises me, especially Rasa, with a historically strong brand reputation. And I’d have thought that Verint, after having acquired Speakeasy.ai, would be in with a shout of being a Leader this year.

- 4 new vendors enter the quadrant: Sprinklr (Challenger), eGain, Inbenta and Laiye (all Niche Players).

Chart showing the change in vendor distribution across MQ categories in 2023 compared to 2022.

- 8 companies have improved performance on both metrics: Ability to Execute and Completeness of Vision (Kore.ai, OneReach.ai, Cognigy, IBM, Avaamo, Boost.ai, AWS and Yellow.ai). This shows the industry has matured and evolved greatly in the last 12 months.

- 3 companies have scored less than last year on both metrics (Sinch, [24]7.ai, Openstream.ai and Omilia), but maintained their position in the quadrant.

- 4 companies have faired better in one metric and either less or the same in the other metric: Google, Aisera and Amelia (up in Completeness of Vision and down in Ability to Execute), and Omilia (down in Completeness of Vision and the same on Ability to Execute). All companies remain in the same quadrant, with the exception of Google which moves from a Challenger to a Leader.

Leaders

- Kore.ai: Moved up in both Ability to Execute and more so in Completeness of Vision. Scores highest of all vendors on Ability to Execute this year and remains a Leader.

- IBM: Moved up in both Ability to Execute and Completeness of Vision. Scores joint highest of all vendors on Completeness of Vision. Remains a Leader.

- Avaamo: One of the biggest improvements in the whole bunch. Avaamo has moved from a Niche Player to a Leader, moving up in both Ability to Execute and Completeness of Vision, and scoring joint highest of all vendors on Completeness of Vision (with IBM).

- Amelia: Still a Leader, scored higher than last year in Completeness of Vision, but less than last year in Ability to Execute.

- Cognigy: Decent jump up in Ability to Execute and a boost in Completeness of Vision. Remains a Leader in 2023.

- OneReach.ai: Moved up in both Ability to Execute and Completeness of Vision and remains a Leader in 2023.

- Google: Moves up a quadrant from Challenger to Leader in spite of losing marks on Ability to Execute. Its boost in Completeness of Vision takes it across and into the Leader category.

- Omilia: Remains a Leader in 2023, but scores less in both Ability to Execute and Completeness of Vision this year.

Challengers

- Yellow.ai: Just missed out on Leader position based on Completeness of Vision, which has improved this year. Though the biggest jump is in Yellow.ai’s Ability to Execute. Along with Avaamo, Yellow.ai is the other company in the quadrant seeing the biggest boost this year.

- Sprinklr: New entrant in 2023, and a strong position for its first year.

- AWS: Another move up from Niche Player into Challenger position owing to an increase in both Ability to Execute and Completeness of Vision.

- Boost.ai: Moved from a Niche Player to a Challenger this year through a slight improvement in Completeness of Vision and a decent jump in Ability to Execute.

Visionaries

- Openstream.ai: The only company in the Visionaries quadrant for the second year in a row. However, scoring less in both areas this year compared to last.

Niche Players

- Laiya: New entrant for 2023, starting strong as the top company in the Challengers category.

- Aisera: Remains a Challenger in 2023, improving its Completeness of Vision, though losing some points on Ability to Execute.

- [24]7.ai: Another vendor remaining a Challenger in 2023, though marked down on both Ability to Execute and Completeness of Vision.

- Inbenta: New entrant in 2023.

- Sinch: Remains a Challenger in 2023, though marked down quite a lot in Ability to Execute and slightly down on Completeness of Vision.

- eGain: The final new entrant of 2023, fairing worst of the bunch but kudos for making the list.

The gaps are showing

Generally speaking, it seems to me as though the platform vendors have upped their game this year for sure, with a few exceptions. More Leaders this year than last, and most of the Leader category have improved their Ability to Execute as well as their Completeness of Vision.

I said at the beginning of 2023 that we’ll start to see some consolidation in the market here. Based on the movements this year, there’s a bigger gap opening up between the Leaders, who’ve almost all improved greatly since last year, and the Niche Players, many of whom have scored poorer this year than last. Simply looking at the comparison chart, the spread of green vs red dots on the map shows the gap emerging.

For the Leaders and new Challengers, 2023 will be all about keeping the foot on the gas. For the Niche Players, Visionaries, and those who missed out this year, there’s work to do to close that gap. A gap that will become wider and harder to close if you’re not careful.

To figure out where you are on the VUX maturity scale for conversational AI, and how you can level up your CX game, consider taking our free 10 minute maturity assessment.